Bangkok ranked 86th most expensive prime office rents

Bangkok ranked 86th most expensive prime office rents

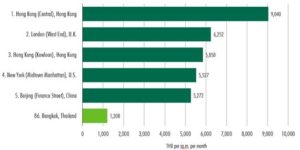

Bangkok ranked 86th in terms of the most expensive prime office rents at Bt1,208 per square metre per month. The Thai capital was also 46th in terms of the biggest annual increase among 122 cities globally, according to the CBRE Global Prime Office Occupancy Costs 2019 report on Tuesday.

Office occupiers continue to seek “higher-quality space” in markets with robust infrastructure and social amenities despite weaker global economic growth in the first quarter of 2019 and worries about the US-China trade war, the report said. The race to attract talent by securing the most desirable work environments also remains intense. Due to limited supply and moderate construction in most cities, prime office occupancy costs have risen to new highs.

These increases persist even as space efficiency and cost management are top concerns for many tenants around the world. The continuing challenge for office occupiers is how to secure quality space and location that meet the increasingly exacting demands of the workforce, while also controlling costs. In this context, measuring superior productivity and user experience of such space becomes ever more important, the report said.

Bangkok is following this global trend. A handful of the best grade A buildings in the central business district (CBD) have rents significantly higher than the average. These buildings are not just in prime locations but are also technically better than their competitors in terms of air conditioning, lifts, energy efficiency and several other factors.

According to the report, the highest rents achieved in Bangkok are in Gaysorn Tower at Bt1,500 per square metre per month, Park Ventures at Bt1,300 and Bhiraj Tower at EmQuartier at Bt1,250, higher than the average CBD grade A rent of Bt1,040 per square metre per month for a small unit.

The rate of increase has, however, slowed over the past 12 months and was below the five-year average. The report said there would be a limited amount of new offices on the market up to 2021, but after that “new supply will exceed historic levels of growth in demand”. Many of the new buildings will be of a very high standard in terms of design, specifications and amenities.

For many tenants, there is an incentive to upgrade as they move to “agile” workplaces where there are no fixed desks. The population densities will be greater and so buildings need better lifts and air-conditioning systems to deal with additional staff. Employees also want better amenities and facilities and, if companies want the best talent, they will need to offer the best office environment.

The unanswered questions are how many office tenants will be willing to pay a premium rent that is higher than the average grade A rent for a better-quality building and how big will that premium be.

Source: https://www.nationthailand.com/property/30376020