Costliest slices of Bangkok

When it comes to some corners of Bangkok, sky-high land prices can be justified, granted the developer gets the product offering right.

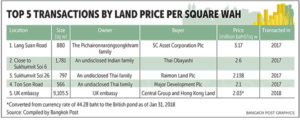

For your average Joe, 100,000 baht per square wah is no trifling sum for a piece of land. But for inner Bangkok, it’s small change, as the area has set a record high of 3.17 million baht per sq wah for a 880-sq-wah plot on Lang Suan Road. (One wah equals two metres.)

SET-listed SC Asset Corporation Plc, which is developing the record-setting plot, remains assured of the area’s strong demand.

Nuttaphong Kunakornwong, chief executive of SC Asset, said hefty land prices in inner Bangkok are reshaping the luxury residential development landscape, as only truly rich Thais and global buyers can afford them.

“I’m confident there is still demand in the super-luxury segment,” Mr Nuttaphong said.

SC Asset offered the highest price through a sealed bid and was the only player to bid above 3 million baht per sq wah. The second-highest bid was 2.6 million baht, said a bidder who asked not to be named.

“SC quoted that price because it really wanted it,” the bidder said.

Based on this land cost, units will reach 500,000 baht per square metre, but Mr Nuttaphong said there are buyers willing to bear this price point.

“The location near Chidlom BTS is the most prime in the country, and the Lang Suan area is like nowhere else,” he said. “We do not aim to launch the highest selling price [per sq m] but we are confident that units priced above 500,000 baht can be sold.”

Ben Taechaubol, chief executive of SET-listed developer Country Group Development Plc, said 3.2 million baht per sq wah is not overpriced for a plot in a prime location, as land prices continue rising, against a decrease in the number of plots to be developed.

“If a developer offers a product that meets the requirements of the luxury segment, prices of 500,000 baht per sq m and above can justify the land prices,” he said. “Luxury is not just a property, but a lifestyle.”

Aliwassa Pathnadabutr, managing director of property consultant CBRE Thailand, said a sharp increase in the price of land plots, particularly those in prime locations, shows that super-prime land remains in high demand because locations are limited.

“There are always concerns about dramatic price increases in any asset class, whether it be central business district land, stock shares, commodities or bonds,” she said. “The price increases are confined to a small area and have not risen in the whole of Bangkok.

“There is a finite amount of demand for super-luxury products unless there is a significant increase in foreign buying, which is why developers attempting to achieve these prices must have a product that buyers believe is super-luxury and worth the price.”

The average prime downtown super-luxury price is 350,000 baht per sq m, which Ms Aliwassa said is acceptable for this market. Products priced at over 500,000 baht per sq m target a very niche market, in which demand is specific to the ultra-luxury market, which is small.

This type of super-luxury product must be in a super-prime location, offer freehold titles, be low-density, and have features and specifications that really match the requirements of this group of buyers, she said.

It is important to note that the sale of this type of product will not be as fast as luxury and other high-end projects with lower prices, Ms Aliwassa said.

A condominium on Phloenchit Road is under construction.

Chatchai Payuhanaveechai, chief executive and president of Government Savings Bank, said foreigners will become a more important part of the Bangkok property market, as condominiums priced higher than 300,000 baht per sq m may not cater primarily to Thais.

Prasert Taedullayasatit, chief executive for high-end condominiums at Pruksa Real Estate, said demand in the luxury segment is varied and comprises real demand, investment buyers and foreigners.

“The high-end condominium market continues to grow,” he said. “Given land acquisitions in the pipeline among large developers, new condominium supply being launched this year will be in the upper-end segment, mostly the Sukhumvit area.”

Ms Aliwassa said many land plots in prime locations released on the market during the past few years, both for sale and rent, have felt the effects of the new inheritance tax, which was created as an incentive to sell.

But a greater motivator has been the rising price of land, which has incentivised some families to convert non-revenue-producing sites into cash with massive capital gains, as they do not have the financial resources or expertise to develop the land themselves.

Suphin Mechuchep, managing director of property consultant JLL Thailand, said prime land plots recently acquired in Bangkok’s central business district have strong potential to accommodate ultra-luxury condominium development projects with prices starting from 300,000 baht per square metre.

In some premium areas such as Wireless, Phloenchit, Lang Suan and lower Sukhumvit, where land prices have skyrocketed on strong demand from major developers, future condominium projects will fetch prices at more than 500,000 baht per sq m, she said.

“Growing scarcity of land for new development in these areas, coupled with excellent accessibility and amenities, justifies such pricings,” Mrs Suphin said.

But new projects must also offer special products with truly superior specifications that will meet and can create demand in a niche market, she said.

The levels of demand in this niche market cannot be underestimated. There are ultra-high-net-worth Thais and foreigners who are looking for an opportunity to own a trophy property asset — a collector’s item — for which they can be proud because of its excellence and rarity, Mrs Suphin said.

“It is clear that ultra-luxury condominiums in Bangkok do not offer attractive rental yields,” she said. “But for people who can afford such premium products, yields do not count.”

“It is clear that ultra-luxury condominiums in Bangkok do not offer attractive rental yields,” she said. “But for people who can afford such premium products, yields do not count.”

Mrs Suphin said concerns over the financial burden from the proposed land and buildings tax are expected to encourage owners to offload their property, particularly that which is high-value and underutilised.

But evidence shows that recent sales of prime land plots in Bangkok have been motivated by other factors.

One of the recent transactions was the sale of the British embassy site on Wireless Road. It was reportedly a part of the British government’s efforts to raise funds for upgrading other embassies around the world.

A sale of the Australian embassy site on Sathon Road acquired last year by SET-listed developer Supalai Plc followed the embassy’s relocation to new premises opposite Lumpini Park.

At the beginning of this year, JLL concluded sales of two prime land plots, for which landlords were motivated by high price offers from several property development firms.

Located in Bangkok’s CBD and sized at two rai each, the two plots were sold for a combined value of more than 3.6 billion baht.

“The proposed land and buildings tax should have a more apparent impact on many property owners when there is more clarity about the new tax scheme and the roll-out plan,” Mrs Suphin said.

“But we do not expect the new tax to lead to distressed sales, particularly for prime real estate assets. Developers and investors will compete fiercely for sought-after assets when they are put up in the market.”

Source: https://property.bangkokpost.com/news/1418415/costliest-slices-of-the-big-mango